Key Takeaways:

- Renters insurance plans do typically offer coverage for laptops and computers under certain scenarios. Some electronic warranties can cover monitors, but you need to ask yourself if those extended warranties are worth it.

- If your home is burgled and a device is stolen, a renters insurance policy will reimburse you.

- Plans also offer coverage for damage related to natural disasters, though not all types of natural disasters are covered.

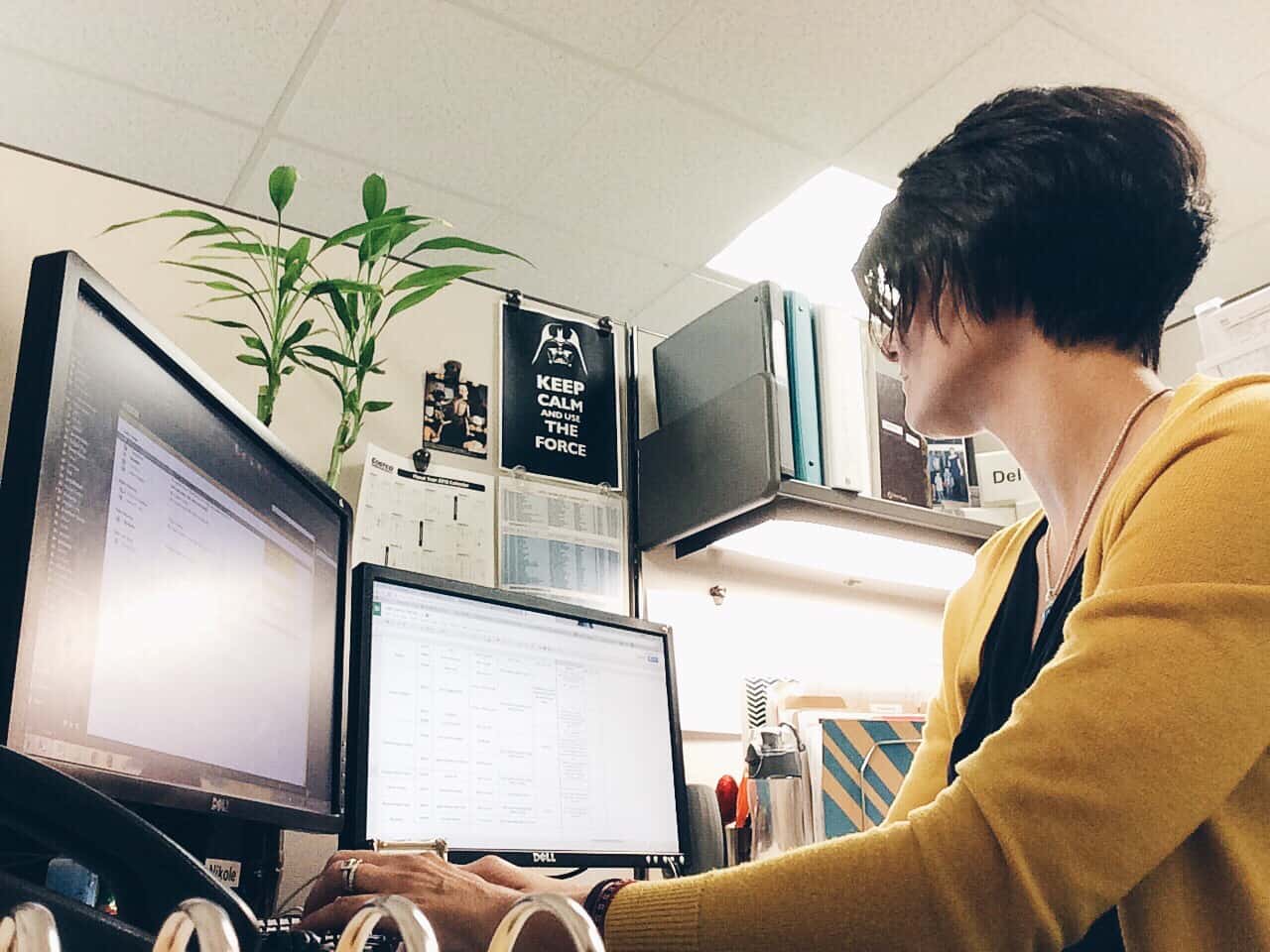

If you have recently rented a home and begun to fill it with valuables, you may be wondering if a renters insurance policy offers any coverage to an item like like computers, laptops, and best computer monitors.

Does Renters Insurance Cover Computers?

You are in luck. Most renter’s insurance does offer benefits for personal belongings like computers, laptops, and related devices if certain conditions are met. These insurance plans consider anything inside of the home you are renting to fall under its purview. This includes protection for all of your gadgets and pieces of electronics.

While renter’s insurance covers your monitor in your home, it won’t cover it if you travel a lot, especially on a plane. In that case, you need to know how to transport a computer monitor on an airplane.

Learn About Renters Insurance and Computers and Laptops

The lion’s share of renters insurance policies, and homeowners insurance, cover laptops and computers in certain, and often specific, scenarios. Let’s go over what kinds of benefits are available when it comes to the personal property clauses of a renters insurance plan.

Related Posts:

Burglary and Vandalism

One of the main reasons consumers flock to a renters insurance plan is that they offer coverage for theft and burglary. What does this mean? If someone breaks into your home and steals your computer or laptop, the cost of the stolen devices will be reimbursed by your insurance provider. You will have to provide your provider documentation regarding the theft, including any relevant police reports and the like. Additionally, you may not get reimbursed for several weeks, so you may have to buy a replacement laptop on your own before the benefits kick in.

Tip: If someone breaks into your home and steals your computer or laptop, the cost of the stolen devices will be reimbursed by your insurance provider

Warning: You will have to provide your provider documentation regarding the theft, including any relevant police reports and the like

Natural Disasters

Most renter’s insurance policies will offer coverage in the event of a natural disaster. This means that if a blizzard or a windstorm blows out your window and your laptop becomes wet and damaged, the repair or replacement costs for the water damage should be covered by your insurance provider. It is important to note that all natural disasters are covered. In general, windstorms, hail, blizzards, and fire are covered, while floods, earthquakes, and mudslides are not covered. Read the fine print of your plan.

Tip: This means that if a blizzard or a windstorm blows out your window and your laptop becomes wet and damaged, the repair or replacement costs should be covered by your insurance provider

Warning: It is important to note that there are certain policy limits and not all natural disasters are covered. In general, windstorms, hail, blizzards, and fire are covered, while floods, earthquakes, and mudslides are not covered by renters policies

Related Posts:

Low Cost

Another benefit of purchasing a renters insurance policy is that they tend to be rather inexpensive. You can expect to pay anywhere from ten to thirty dollars a month to get your rental unit in your building or your entire home covered, which includes $10,000 to $50,000 of personal property coverage. Shop around for deals and if a personal property damage policy seems too good to be true and will provide replacement cost coverage for all accidents and expensive items, be sure to take some time to thoroughly read over the policy details, since coverage limits usually exist for more affordable standard policies. Some plans demand that a rather large deductible be paid in full before any benefits kick in.

Tip: You can expect to pay anywhere from ten to thirty dollars a month to get your entire home covered, which includes $10,000 to $50,000 of personal property coverage

Warning: Some plans demand that a rather large deductible be paid in full before any benefits kick in

STAT:

In 2019, a whopping 79.6 percent of laptop claims handled by insurance provider Lemonade were theft-related. (Source)

Sources:

https://en.wikipedia.org/wiki/Renters%27_insurance

https://golden.com/wiki/Lemonade_(company)-5KKMBYB

https://research.stlouisfed.org/publications/page1-econ/2020/02/03/renters-and-homeowners-insurance-when-the-unexpected-happens

https://go.gale.com/ps/anonymousid=GALE%7CA11669867&sid=googleScholar&v=2.1&it=r&linkaccess=abs&issn=00223905&p=AONE&sw=w

![Best 27 Inch Computer Monitor in [year] 27 Best 27 Inch Computer Monitor in 2026](https://www.gadgetreview.dev/wp-content/uploads/how-to-buy-the-best-computer-monitor.jpg)

![Best BenQ Monitors in [year] 28 Best BenQ Monitors in 2026](https://www.gadgetreview.dev/wp-content/uploads/best-benq-monitor-image.jpg)

![Best ASUS Monitors in [year] 29 Best ASUS Monitors in 2026](https://www.gadgetreview.dev/wp-content/uploads/best-asus-monitor-image.jpg)

![Best Dell Monitors in [year] 30 Best Dell Monitors in 2026](https://www.gadgetreview.dev/wp-content/uploads/best-dell-monitor-image.jpg)

![Best HP Monitors in [year] 31 Best HP Monitors in 2026](https://www.gadgetreview.dev/wp-content/uploads/best-hp-monitor-image.jpg)

![Best Lenovo Monitors in [year] 32 Best Lenovo Monitors in 2026](https://www.gadgetreview.dev/wp-content/uploads/best-lenovo-monitor-image.jpg)

![Best ViewSonic Monitors in [year] 33 Best ViewSonic Monitors in 2026](https://www.gadgetreview.dev/wp-content/uploads/best-viewsonic-monitor-image.jpg)

![Best Gigabyte Monitors in [year] 34 Best Gigabyte Monitors in 2026](https://www.gadgetreview.dev/wp-content/uploads/best-gigabyte-monitor-image.jpg)

![Best Monitors for PS4 Pro Gaming in [year] 35 Best Monitors for PS4 Pro Gaming in 2026](https://www.gadgetreview.dev/wp-content/uploads/best-monitors-for-ps4-pro-image.jpg)

![Best Monitor for Xbox Series X in [year] 36 Best Monitor for Xbox Series X in 2026](https://www.gadgetreview.dev/wp-content/uploads/best-monitor-for-xbox-series-x-image.jpg)

![Best Acer Monitors in [year] 37 Best Acer Monitors in 2026](https://www.gadgetreview.dev/wp-content/uploads/best-acer-monitor-image.jpg)

![Best MSI Monitors in [year] 38 Best MSI Monitors in 2026](https://www.gadgetreview.dev/wp-content/uploads/best-msi-monitor-image.jpg)

![Best SAMSUNG Monitors in [year] 39 Best SAMSUNG Monitors in 2026](https://www.gadgetreview.dev/wp-content/uploads/best-samsung-monitor-image.jpg)

![Best LG Monitors in [year] 40 Best LG Monitors in 2026](https://www.gadgetreview.dev/wp-content/uploads/best-lg-monitor-image.jpg)

![Best AOC Monitors in [year] 41 Best AOC Monitors in 2026](https://www.gadgetreview.dev/wp-content/uploads/best-aoc-monitor-image.jpg)

![Best Philips Monitors in [year] 42 Best Philips Monitors in 2026](https://www.gadgetreview.dev/wp-content/uploads/best-philips-monitors-image.jpg)

![Best Monitors For PUBG in [year] 43 Best Monitors For PUBG in 2026](https://www.gadgetreview.dev/wp-content/uploads/best-monitor-for-pubg-image.jpg)

![Best Stream Decks in [year] 44 Best Stream Decks in 2026](https://www.gadgetreview.dev/wp-content/uploads/best-stream-deck-image.jpg)

![Best Monitors for Streaming in [year] 45 Best Monitors for Streaming in 2026](https://www.gadgetreview.dev/wp-content/uploads/best-monitor-for-streaming-image.jpg)

![Best Monitors For Flight Simulator in [year] 46 Best Monitors For Flight Simulator in 2026](https://www.gadgetreview.dev/wp-content/uploads/best-monitor-for-flight-simulator-image.jpg)